Best Free Tax Filing Software 2021: File your 2020 taxes online for free

We have collated the best tax filing applications that seek to simplify the entire process, saving you time, money, and headaches

In a phrase popularised by the founding fathers’ version of Emmet Brown, two things in life are certain: “death and taxes.” Both of which are known to cause immense levels of dread and anxiety as they draw near.

Much like the justice system is a swamp of archaic legalese designed to obfuscate and overwhelm the average Joe, the IRS’ absurd, triple-digit collection of differing forms all relating to filing your taxes is enough to explain the existence of the tax-preparation industry alone. But before you hand off this year’s numbers to a professional, we have collated the best tax filing applications that seek to simplify the entire process, saving you time, money, and headaches.

The best free tax filing apps will slice through the tax-man jargon, delivering clear and concise direction during the process, resulting in the most accurate calculation of what you owe or are owed. What’s even better is that each of the apps we’ve highlighted has free services and all but one of our picks are partners to the IRS Free Filing program. This means you won't have to put yourself out of pocket during a difficult tax year.

Do you qualify for Free Filing?

Why you can trust Laptop Mag

Free Filing is an IRS program in partnership with numerous big-name tax preparation brands that offers anyone with an adjusted gross income of less than $72,000 a pathway to filing their tax returns for free. Almost all of our picks are available through this program, with the only exception being Credit Karma Tax due to being entirely free to use regardless of the circumstance. You can find a list of all of the Free File partners (not just the ones we have highlighted), criteria for eligibility, and answers to frequently asked questions on the IRS Free File page.

It’s important to note that some services like TurboTax and FreeTaxUSA have a lower adjusted gross income cap to qualify for Free Filing at $39,000. So, while each of the services will allow you to file your federal taxes without charge, you may have to pay when it comes to your state tax filings.

If you don’t qualify for the IRS Free Filing program, and you are looking to file a simple tax return, a number of apps will still allow you to freely (excluding state returns cost) submit your tax filings through their software. Many of the apps we have listed also offer their own free services which can be just as useful as the Free File program.

Feeling overwhelmed? That’s OK!

Not everybody has the time or understanding to tackle their taxes themselves. Should you feel unsure about your DIY taxing abilities, or have a less standard tax requirement involving investments, dependents, or have recently bought a house, married, or had a child, etc. then a tax professional might be your best bet.

Services like TurboTax and H&R Block offer tools at a premium that will allow you to digitally share your documents with a tax professional online and have them do the majority of the work for you within days.

Which tax software is best?

The tax software that will work best for you depends entirely on your familiarity with e-filing taxes, the complexity of your tax situation, and your adjusted gross income.

If you’re not overly familiar with the process or feel more comfortable with a more guided approach, TurboTax’s incredibly user-friendly methods might fit you best. Also, should your adjusted gross income be less than $39,000 and you only want to file simple taxes, you can use the platform to e-file your federal taxes for free.

If you’re more familiar with how things work and feel confident enough to trade in-depth support for a free solution, Credit Karma Tax is an entirely free option that will take care of both federal and state taxes without costing you a single cent.

On the other hand, if you have an Adjusted Gross Income between $39,000 and $72,000, TaxSlayer and TaxAct will allow you to submit simple tax returns for free. Both offer a basic level of support should you need help, while only resulting in charges for state tax filings.

If you’re unsure of which software suits you best, TurboTax would be our recommended app. It can assess your situation and guide you through the process, and if things get a little too stressful, you can always pass your information on to a tax professional for them to complete your returns for you (for a fee).

You’re free to trial many of the apps we’ve sourced and see which one leaves you confident in your undertakings, so don’t be shy about visiting the sites to test their free services and see which suits you best. Most of the time, you only need to think about paying near the end of your filings.

The best tax software 2021

- TurboTax

- TaxSlayer

- FreeTaxUSA

- TaxAct

- Credit Karma Tax

Honorable mention: What about H&R Block?

H&R Block is undoubtedly a popular choice among e-filers; you’ll commonly see it recommended for its capabilities and ease of use. Its exclusion from this list isn’t down to its lack of quality or its capacity to allow users to freely file their tax returns.

In fact, H&R Block has three of its own services that help many taxpayers do just that. And should you feel more confident in H&R as a brand or from previous experience, don’t hesitate to look into their services. Just to emphasize, its omission is not to be taken as a lack of confidence in the software’s performance or accessibility.

In July 2020, it was announced that H&R Block would, as of October 2020, no longer be a partner within the IRS Free Filing program. The entries in our best tax software list primarily focus on those within that partner program with the only exception being Credit Karma due to its unique pricing approach to e-filing your tax returns. Therefore, while we acknowledge H&R Block as a fantastic all-rounder, and a contender to best overall tax filing software, we felt it best to set it aside in this context.

1. TurboTax

Reasons to buy

Reasons to avoid

Intuit, the software company responsible for TurboTax, lays claim to almost 55% of the market share when it comes to DIY tax filings. This is most likely explained by the accessibility and humanizing element of its tax return experience. You’re likely to see TurboTax fighting it out with tax-filing contemporary H&R Block for the top spot in many tax software lists you come across, and it’s not hard to understand why.

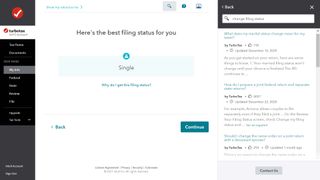

Instead of being faced with walls of text and dizzying amounts of checkboxes, TurboTax works out what you need via a series of probing, yet friendly questions. For example, you may be asked about your year; which may include marriage, a new child, or becoming self-employed. TurboTax then determines the forms you’ll need and any further information it will require to complete them. The results for the user are among the best that any have to offer. Its conversational format brings a hint of the casual to an otherwise intimidating task.

That can, of course, all come crashing down when you are met with paywalls or upselling opportunities. Eviscerating the mirage of a friendly chat with Tax-Bot 9000, and undoing a lot of the effort made to make the process as uncomplicated as possible.

While TurboTax is a partner for the IRS Free File program, readily coming across that service is at times harder than it needs to be, with Intuit instead pushing their own free service on users. You can, however, locate it with ease through the IRS’s Free File partners page –– something highly recommended if all you need is a simple tax return without too much fuss.

TurboTax is one of the more expensive options should you need anything more complex. For example, the Self-Employed focused package costs $120 (down to $90 at present). Balancing this out is the unparalleled level of support and documentation on hand, its ease of use, and not to mention, TurboTax’s stand-out efforts to pinpoint deductibles that aid you in getting the best refund possible. You can also unshackle yourself from your desktop and continue your tax filing progress at your own pace with the TurboTax phone app for Android and iOS.

2. TaxSlayer

Reasons to buy

Reasons to avoid

At a glance, you’d be forgiven for thinking this was the name of the IRS’ in-house death metal band, but TaxSlayer is, in fact, a highly versatile tax filing software where you pay for the support you need rather than the forms you require.

TaxSlayer, while being a part of the IRS’ Free File program, also has a free service of its own. The ultrabasic ‘Simply Free’ package they offer gives you access to the 1040 form, along with one free federal and state return. You can declare your W-2 along with any education expenses or student loan interest, and TaxSlayer will let you upload your previous year’s tax return to compare the figures.

The ‘Simply Free’ service does include some support should you find yourself hitting a wall. There are step-by-step instructions available alongside email and phone support. Should you require more support or something less basic, TaxSlayer also has you covered.

TaxSlayer’s Simple package will cost you a flat $17 and give you access to all the forms you’ll need. While filing state returns will cost extra, there’s no hidden paywalls and no forced upgrades. If you already know what you’re doing, and are looking to file a more complex tax return, TaxSlayer will provide you with everything you need to get things done as efficiently as possible in one shot.

The more premium the service you subscribe to, the more in-depth help will be made available to you. This can range from accessing live chat support all the way to contacting a tax professional directly for guidance.

The low cost of entry makes TaxSlayer a fantastic value for the money and a great service for people familiar with the process to use.

3. FreeTaxUSA

Reasons to buy

Reasons to avoid

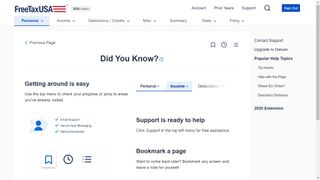

FreeTaxUSA isn’t the most accurate name for this particular app, but the more precise ‘MostlyFreeTaxUSA’ sounds stupid and far less snappy.

Most tax-filing apps have free services, with caveats. If you’re looking to file a simple tax return you’re usually good to go. However, if you’re needing anything more specialized you’ll very quickly find yourself surrounded by paywalls for premium services. FreeTaxUSA manages to offer more bang for no bucks than most other tax preparation filers when it comes to complex filings.

If you need to include the likes of HSAs, itemized deductions, or capital gains/dividend/rental/employment incomes, most other services will expect you to upgrade from a free package to a premium. FreeTaxUSA allows you to do all that and more without expecting a single cent.

While federal returns through FreeTaxUSA are free, state returns are not. However, the cost is a fraction of what other brands will charge you. The competition may place a figure between $30 and $50 on similar state returns (sometimes more depending on which package you choose), but FreeTaxUSA manages to offer this for $12.95 across the board.

Upgrading to the deluxe edition costs only $6.99 more and will bolster the middling support available for free users with live chat and priority support. It’s a small price to pay to round out a fantastic bit of software that has you covered for next to nothing already.

4. TaxAct

Reasons to buy

Reasons to avoid

On the surface, TaxAct doesn’t seem all that impressive. Much like the other apps we have highlighted, it can be used to file simple tax returns for free (thanks to the IRS Free File program), though you will have to pay a small $4.95 state filing fee. TaxAct also offers a similar free service of its own; you will even be entitled to unlimited support via email, phone and live chat, something that a lot of other services reserve for premium options.

TaxAct features multiple tiers of premium services, and what makes these tiers stand out against the competition is the pricing. Comparing TaxAct’s premium services to TurboTax’s reveals that, for essentially the same access to each tailored package, you can find yourself saving anywhere between 27% and 50%. TaxAct is acting as a no-frills alternative to what the most popular brands have to offer. As such, while the service may lack the polish or depth of other systems and their knowledge bases, functionally TaxAct can give you a similar level of support and results without having to pay a similar price.

To some, the money saved using TaxAct’s service will outweigh the handful of features similar services offer that they won’t have access to. It prioritises function over form, and if you’re familiar with the e-filing process already and want to shave off some cost from this year's filings, TaxAct could potentially be your solution.

5. Credit Karma Tax

Reasons to buy

Reasons to avoid

Credit Karma is very much the wild card in the pack when it comes to our selection. Other software will often claim to have its own free service, but that’s usually ‘free’ with an asterisk.

Credit Karma, on the other hand, is free. No asterisk. It’s the only service that truly offers both federal and state filings at no cost to its users. Because of this, it’s the only service from our pick that isn’t partnered with the Free Filing program. Mainly because it doesn’t need to be. Credit Karma can even provide free weekly credit scores and reports. And for the low, low price of $0, Credit Karma is the cheapest option when it comes to filing a Schedule C.

So what’s the catch? Surely there’s some way of Credit Karma squeezing you for cash, even if it’s by selling your data on to advertisers, right? No. Credit Karma will never sell your data and instead relies on recommending products to you via a partner program based on an algorithm and your credit profile.

The major downside to this deal is the limited support. You won’t get the kind of support available in TurboTax or TaxSlayer. In comparison, the help available here is stripped back considerably. While Credit Karma lets you know what it requires of you at each stage, the search for further explanations showcases a lack of depth currently available within the software. There are no tax experts to confer with, and the documentation available isn’t always as clear as the competition. As such, this isn’t going to be as friendly to users as the alternatives, especially if they’re new to DIY tax filing.

Credit Karma is currently the only service that is 100% free, which is an attractive prospect to those who know what they need, are familiar with the process, and feel comfortable enough to e-file their tax returns without too much hand-holding.

Be cautious of upselling

The IRS estimates that up to 70% of all taxpayers will take advantage of the Free Filing program. And while you may find yourself within that bracket, many of the tax preparation brands have made efforts to upsell customers regardless.

As previously mentioned, tax preparation is big business. It generated revenues of $11 billion in 2019 and is estimated to continue its growth well into the 2020s. While many brands within the industry have agreed to offer a Free Filing pathway, they do so begrudgingly.

Some of the industry’s software giants have spent countless sums of money to prevent the IRS from creating and distributing its own tax preparation and filing service, and see joining the IRS Free Filing program as little more than a stalling tactic that maintains their market share. But their partnership only means they have to make that option available, not make it easy to find.

Companies like TurboTax creator Intuit have, in the past, actively gone out of their way to misdirect users into purchasing unnecessary services from them. If you attempt to navigate their sites directly, often using bait-and-switch tactics to trick you into thinking their own advertised free* package is the same as the Free File program. It isn’t, and it can lead to you feeling like you’re being held hostage when you’re hit with a paywall just as you’re ready to submit your filings.

Some companies will even go out of their way to prevent the Free Filing page of their sites to appear on search engines. Or they’ll make it difficult to navigate from their webpages in order to further distract users. So if you want to avoid the upsell, we recommend you choose your preferred Free File partner directly from the IRS’s dedicated Free File partners page.

Stay in the know with Laptop Mag

Get our in-depth reviews, helpful tips, great deals, and the biggest news stories delivered to your inbox.

Rael Hornby, potentially influenced by far too many LucasArts titles at an early age, once thought he’d grow up to be a mighty pirate. However, after several interventions with close friends and family members, you’re now much more likely to see his name attached to the bylines of tech articles. While not maintaining a double life as an aspiring writer by day and indie game dev by night, you’ll find him sat in a corner somewhere muttering to himself about microtransactions or hunting down promising indie games on Twitter.